You’ve likely heard about all the benefits of having a Roth IRA, and you want to take advantage of that tax-free growth. But what if you’re a college student working part time, or just started your first job and don’t have the thousands of dollars required to open a Vanguard or Fidelity account? Is it possible to open a Roth IRA with no minimum, and are there any decent choices available?

You’ve likely heard about all the benefits of having a Roth IRA, and you want to take advantage of that tax-free growth. But what if you’re a college student working part time, or just started your first job and don’t have the thousands of dollars required to open a Vanguard or Fidelity account? Is it possible to open a Roth IRA with no minimum, and are there any decent choices available?

Yes. Before we begin, allow me to clarify the issue of no minimum. Quite simply, this means that you do not need to hand over any money just to open an account. If any funds within the account require a minimum investment, I will clarify further.

You can always keep saving until you have $3,000 or so to invest, but here are two good choices for places where you can open an account NOW, not later.

Option 1 – Capital One Investing

Required to open an account: $0Two choices available: Savings or Investment IRAFor Investment IRA, some funds require a minimum investment of $250

Update: Capital One Investing has sold their investing service to E*Trade.

Option 2 – Schwab

- Required to open an account: $0

- Schwab mutual funds require a $100 minimum investment, and only $1 for additional contributions

It’s no secret that I like Schwab (see review). Their website states that the required minimum to open a Roth IRA is $1,000 (or $100 automatically every month), but there’s an easy way around that. I just chatted with one of their CSRs for confirmation. Here’s how it works.

Open a Roth IRA online. You are not required to fund the account immediately, so no money is required upfront. Once the account is open, use their MoneyLink feature to link your existing checking or savings account to Schwab. After you verify the trial deposits, transfer in however much you want – hopefully at least $100. If you don’t even have $100, why are you looking at a Roth IRA again?

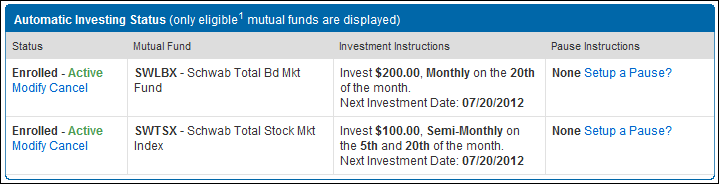

You can then use their Automatic Investing Plan (AIP) to schedule monthly investments. Schwab mutual funds only require $100 to open, so pick a fund of your choice (SWTSX is a great choice, as it’s a low-expense index fund that covers the total US stock market) and schedule your $100 automatic investment.

But… but…, you’re asking, I thought this was supposed to be about no minimums? You’re telling me I have to commit to $100 every month? Rabble… rabble, RABBLE!

Calm down. The beauty of this system is that Schwab does not pull directly from your checking account. You first transfer the money into your Schwab Roth IRA, and then the money is automatically invested on the specified date. If insufficient money is available, no investment will be made for that month. Here’s the fine print on their site:

Cash up front is required for Automatic Investment Plan trades. If there is no money in the account on the day of the Automatic Mutual Fund Investing transaction, no trade will be placed (unless there is sufficient margin cash available). Automatic Mutual Fund Investing instructions will remain in effect until you delete them.

So drop your pitchfork. Throw in as much money into your Roth IRA as you can, and Schwab will automatically invest it for you each month. If you miss a month or two, no big deal. This is a little more complicated than, say, an ING Direct savings account, but the investment choices with low expense ratios are much more broad.

Other Thoughts

You no longer have any excuses not to open a Roth IRA, and I certainly don’t want to hear anything about how I don’t have enough money to open an account anywhere. Wah! Yes, you do. Even if you’re a college student working a part-time job, you can now afford to open an IRA. Just skip the movies or the bar tonight and toss the money into a Roth instead. You’ll thank me 30 years from now.