Previously I posted the content of my taxable investment portfolio. In that same spirit, it’s now time to sneak a peek inside my tax-advantaged accounts. Here’s how everything looks as of August 2012.

Roth IRA – Through Schwab

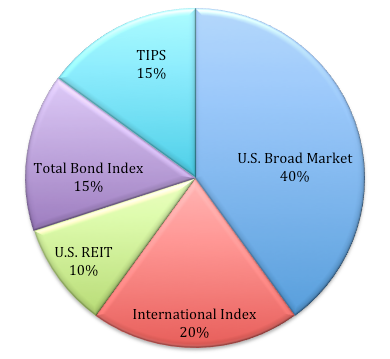

Current allocation: 70% Stocks / 30% Bonds

If one uses the age-in-bonds method to derive asset allocation, then the current split of 70% stocks / 30% bonds in my Roth IRA is tilted slightly to the aggressive side (I’m 33 presently). However, I prefer to consider asset allocation on a per-account basis and not worry about the whole. In my mind, if I take care of each gear, then the machine will run smoothly, and I spend little time worrying about my overall asset allocation. Each account has a purpose: my taxable investments must grow and generate enough dividends to augment my early-retirement income up to age 59.5, and my two tax-advantaged accounts will patiently wait to grab the baton and run from there.

Roth IRA Stock Holdings:

- Schwab U.S. Broad Market ETF (SCHB)

- Schwab International Index Fund (SWISX)

- Schwab U.S. REIT ETF (SCHH)

Roth IRA Bond Holdings:

Four of the five funds in my Roth are ETFs. I generally prefer mutual funds, but Schwab made their ETF offerings tempting by allowing them to trade without commission and by making their expense ratios lower in every case compared to their own line of mutual funds. I have kept only one mutual fund for now (SWISX), as its expense ratio is only negligibly higher than its ETF counterpart (0.19 versus 0.13), and having even a single mutual fund allows me to sweep any loose change into it, as one can only purchase whole shares of ETFs (though Schwab does allow automatic dividend reinvestment into partial shares).

Regarding asset allocation, I plan to keep my Roth IRA relatively unchanged, at least for the next decade. By the time I turn 60, I expect to have dialed it back to roughly 50/50.

403(b) – Through Fidelity

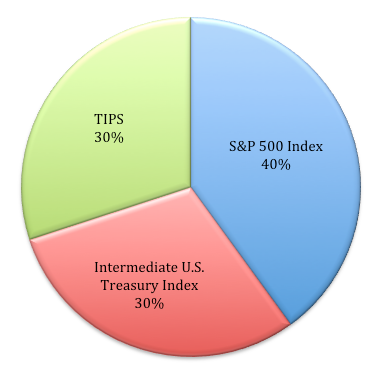

Current allocation: 40% Stocks / 60% Bonds

And now we get to see my more risk-adverse side.  Through my university, I have a 403(b) held at Fidelity, and I feel lucky because I have some excellent fund choices available with extremely low expense ratios.

Through my university, I have a 403(b) held at Fidelity, and I feel lucky because I have some excellent fund choices available with extremely low expense ratios.

403(b) Stock holdings:

- Spartan 500 Index Fund – (FUSVX)

403(b) Bond Holdings:

- Spartan Intermediate Treasury Bond Index Fund (FIBAX)

- Spartan Inflation-Protected Bond Index Fund (FSIYX)

For this particular account, I lean toward the conservative side. I like to think of it as a counterbalance to my more-aggressive Roth IRA. My contributions occur on a monthly basis through automatic payroll deduction (plus employer match), thereby taking advantage of dollar-cost-averaging to build shares.

I’m conscious that there’s some overlap with the asset types held in my Roth IRA, but I haven’t decided what – if anything – I should do about it. Maybe I should practice the Bogle-esque mindset of “Don’t just do something, stand there!” Admittedly, I do enjoy holding more bonds in this account, partly for tax-advantageous reasons, and partly because I have this irrational mentality that my employer is giving me extra money each month and I want to keep all of it! Therefore, I hold more bonds than stocks here, I and thoroughly enjoy watching the dividends get fatter and fatter each month.

Summary

The only thing permanent in this life is impermanence, but minor tweaks aside, I plan to let my tax-advantaged investments roll like this for a while. For the foreseeable future, I want to continue holding more stocks in my Roth IRA and more bonds in my 403(b).

Based on the amounts in each account, if I were to take a wild stab at my overall asset allocation, I’d wager that it’s somewhere in the vicinity of 60% stocks and 40% bonds. By the time I turn 60 – or maybe 65 – I plan to dial it back to somewhere around 35/65 with the ideal plan that the dividends across all accounts are generating enough income that I hardly need to touch the principal. That’s a long time from now, though, and who knows what the future holds? In the meantime, I’ll keep socking money into these accounts according to the plan outlined here and do my best to forget about it.